Auto Insurance in and around Chicago

Discover your car insurance options from State Farm

All roads lead to State Farm

Would you like to create a personalized auto quote?

State Farm Has Coverages For Your Needs

You've got the car. Now it's time to put it into drive and choose the right insurance.

Discover your car insurance options from State Farm

All roads lead to State Farm

Protect Your Ride

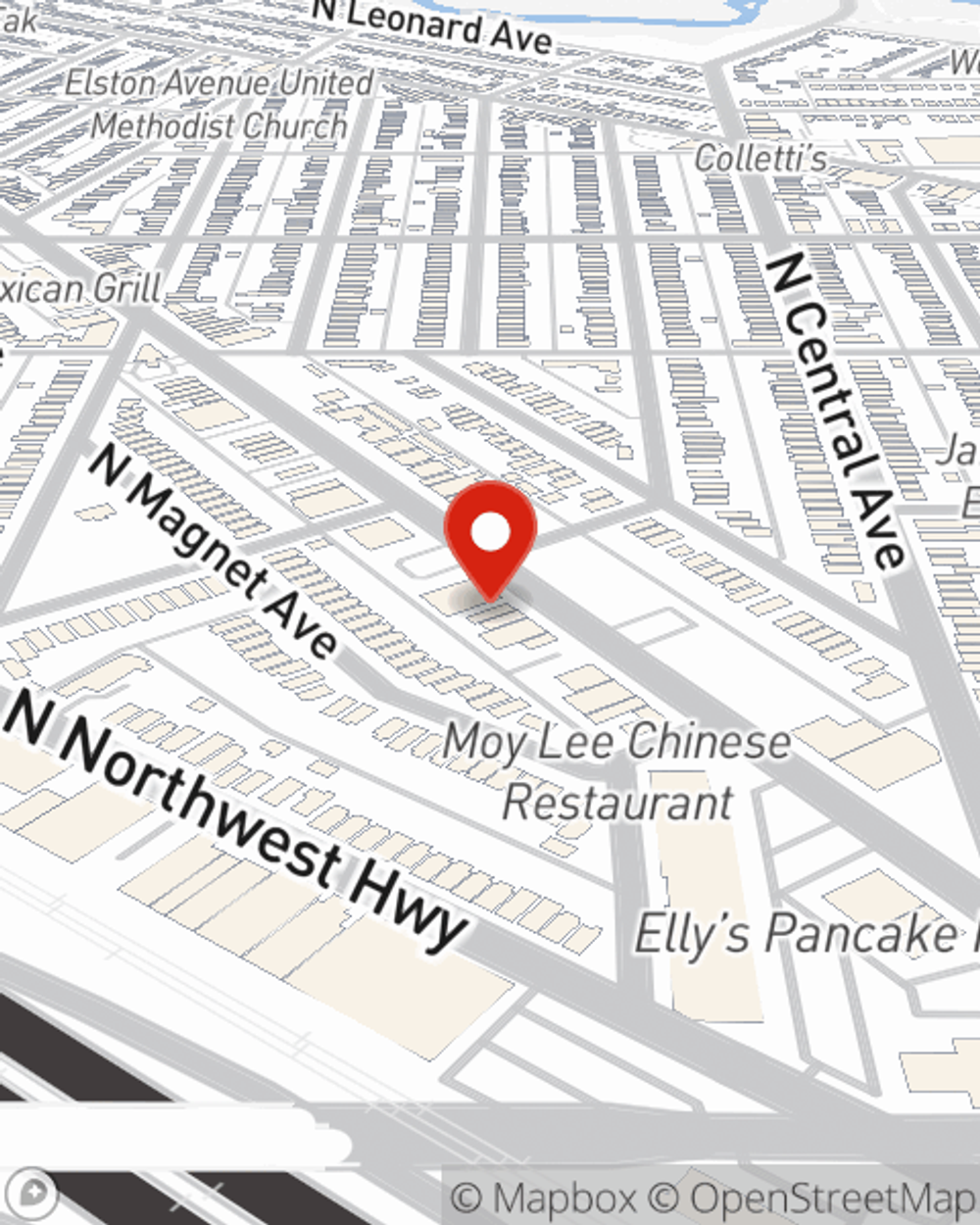

Whether you're looking for dependable protection for your vehicle like emergency road service coverage, comprehensive coverage and car rental and travel expenses coverage, or fantastic savings options like Steer Clear® and an older vehicle passive restraint safety feature discount, State Farm can help. State Farm agent Mike Callahan can help you choose which particular options are right for you.

You don't have to ride solo when you have insurance from State Farm. Contact Mike Callahan's office today for more information on how you can save with State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Mike at (773) 775-1880 or visit our FAQ page.

Simple Insights®

What to do if you put the wrong gas in your car

What to do if you put the wrong gas in your car

Pumping the wrong fuel can happen to anyone. Learn about possible scenarios and solutions in case it happens to you.

Use less gas with these fuel efficiency tips

Use less gas with these fuel efficiency tips

You can improve fuel efficiency and save money at the pump with these simple driving tips.

Mike Callahan

State Farm® Insurance AgentSimple Insights®

What to do if you put the wrong gas in your car

What to do if you put the wrong gas in your car

Pumping the wrong fuel can happen to anyone. Learn about possible scenarios and solutions in case it happens to you.

Use less gas with these fuel efficiency tips

Use less gas with these fuel efficiency tips

You can improve fuel efficiency and save money at the pump with these simple driving tips.