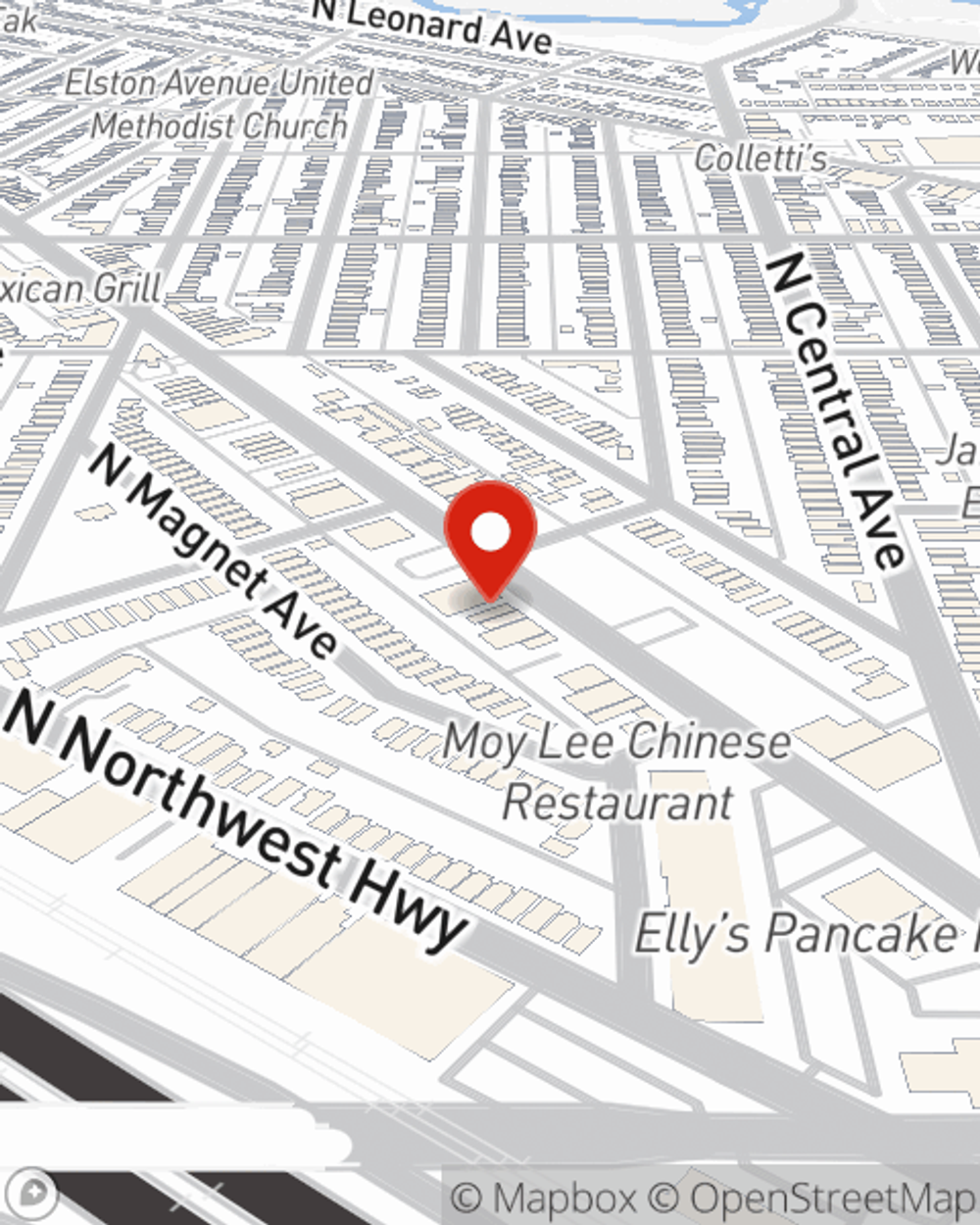

Life Insurance in and around Chicago

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

No one likes to think about death. But taking the time now to arrange a life insurance policy with State Farm is a way to demonstrate love to the people you're closest to if you pass away.

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Wondering If You're Too Young For Life Insurance?

Having the right life insurance coverage can help loss be a bit less debilitating for those closest to you and allow time to grieve. It can also help meet important needs like grocery bills, car payments and college tuition.

Don’t let the unexpected about your future keep you up at night. Contact State Farm Agent Mike Callahan today and discover how you can rest easy with State Farm life insurance.

Have More Questions About Life Insurance?

Call Mike at (773) 775-1880 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Mike Callahan

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.